Buy your own home VS Choosing to rent

Recent Blogs

Why Location Analysis Matters More Than Price Alone In Real Estate

19th January, 2025

Read More

How to Find Your Ideal Property Using Smart Search Features

2nd January, 2025

Read More

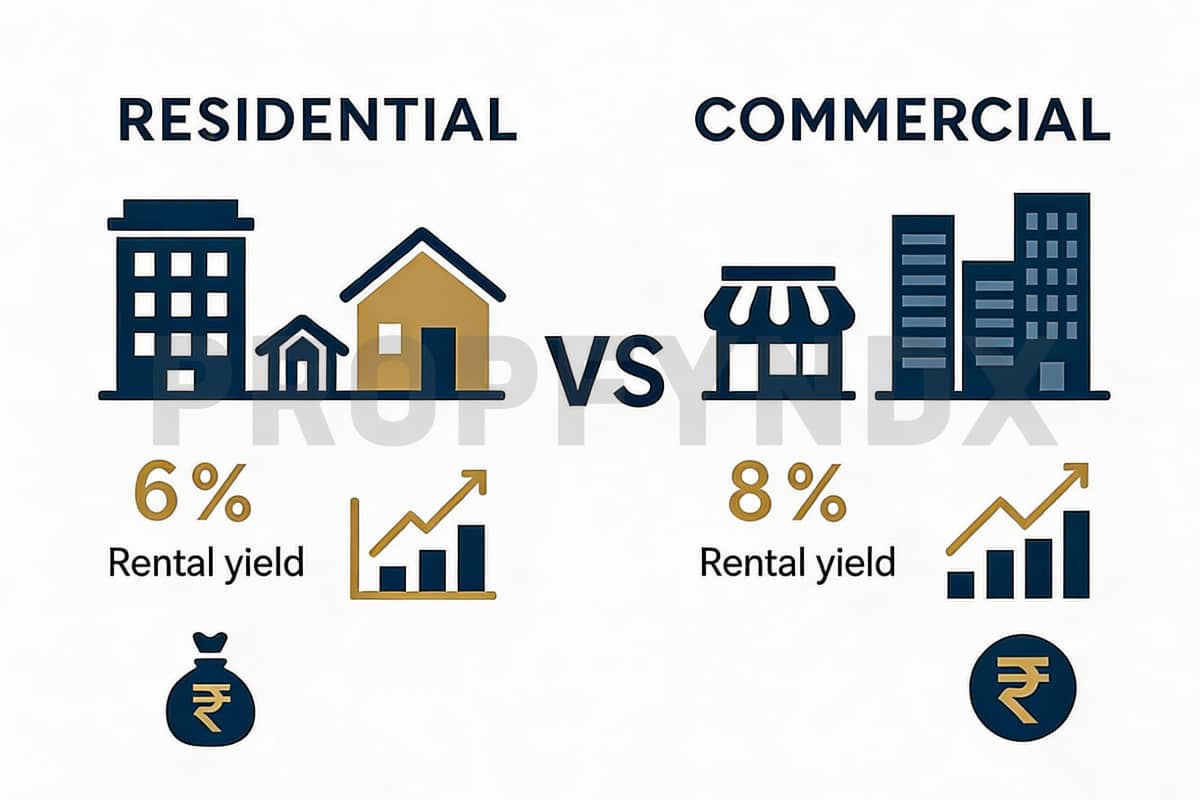

Comparing Investment Returns: Residential vs. Commercial Projects

19th December, 2025

Read More

PropTech in 2026: Why Platforms Like PropFyndX Are Transforming Real Estate

02nd December, 2025

Read More

Ready-to-Move vs Under-Construction Properties: Pros, Cons & ROI

28th November, 2025

Read More

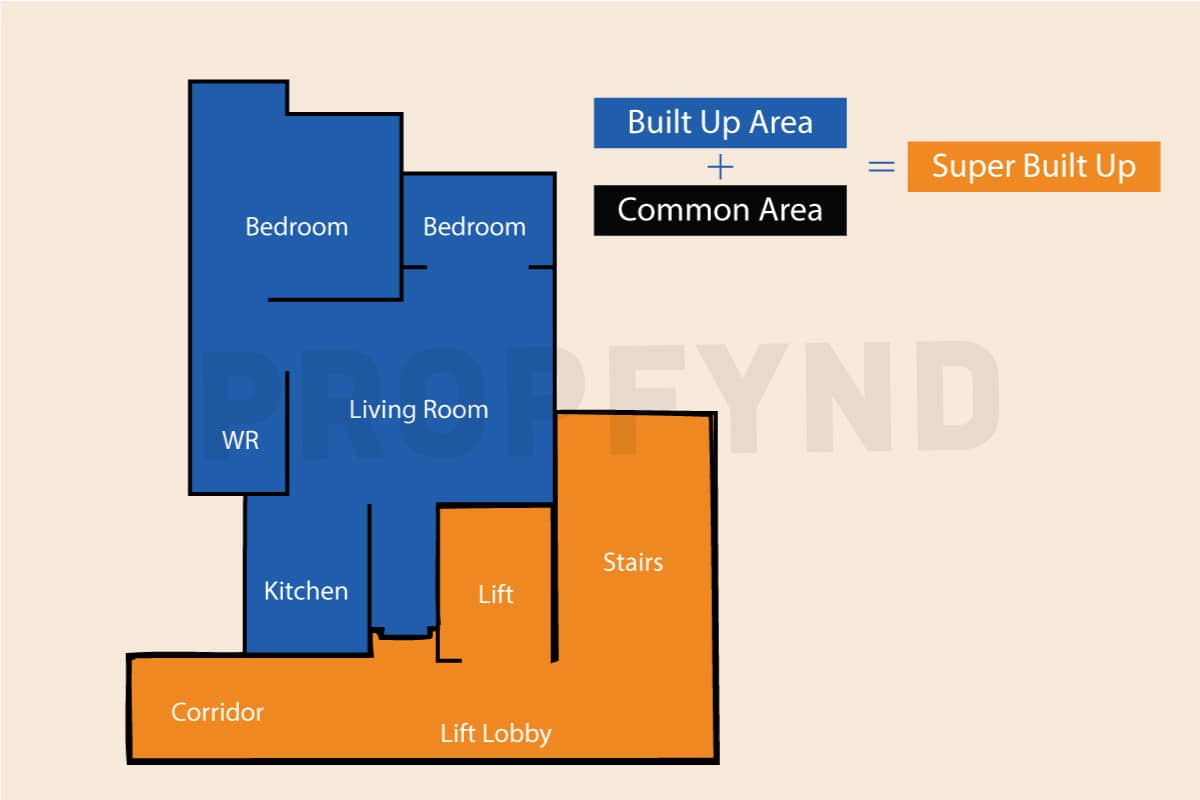

Guide On Carpet Area vs Built-Up vs Super Built-Up Area

27th November, 2025

Read More

Property Discovery Made Simple: How Propfyndx Helps Buyers Save Time

27th October, 2025

Read More

Hidden Costs of Buying a Home: What Property Buyers Overlook

15th October, 2025

Read More

Property Discovery Made Simple: How Propfyndx Helps Buyers Save Time

30th September, 2025

Read More

Residential Vs Commercial: Which Property Type Should You Choose?

15th September, 2025

Read More

RERA Explained: What Every Real Estate Buyer Must Know

22nd August, 2025

Read More

Is It The Right Time To Invest In Commercial Properties In India?

12th August, 2025

Read More

10 Real Estate Ad Mistakes That Are Costing You Conversions

6th August, 2025

Read More

Know How RERA Regulations Are Reshaping Property Marketing in India

30th July, 2025

Read More

How Interest Rate Changes Are Impacting Homebuyers?

30th June, 2025

Read More

Boost Your Real Estate Sales: How Paid Ads Can Help You Sell Properties Faster

20th June, 2025

Read More

Breaking Barriers in PropTech: Challenges & Solutions for Real Estate Innovation

6th June, 2025

Read More

Co-Living & Co-Working: Smart Solutions for Smarter Cities

8th April, 2025

Read More

The Future of Real Estate: How AI is Changing the Game

20th February, 2025

Read More

How Proptech Solutions Are Revolutionising Real Estate in 2025

20th February, 2025

Read More

The Ultimate Guide to Finding the Perfect Warehouse Space for Rent in Mumbai

31th January, 2025

Read More

7 Must-Have Amenities That Define Modern Residential Projects

27th January, 2025

Read More

The Ultimate Guide to Real Estate Digital Marketing in 2025

11th December, 2024

Read More

Top Reasons Why Indians Choose Dubai for Property Investments

28th Nov, 2024

Read More

How does machine learning assist in lead generation for real estate?

20th Sept, 2024

Read More

Luxury Real Estate In Mumbai Registers Record Growth

28th August, 2024

Read More

What’s the significance of virtual tours in the home-buying process?

13th August, 2024

Read More

Why Kalyan Is Emerging As A Preferred Choice For Homebuyers?

19th March, 2024

Read More

The Impact Of The Mumbai Coastal Road Project On Real Estate In Mumbai

11th March, 2024

Read More

How is Andheri’s real estate market shaping up?

5th March, 2024

Read More

Why Thane West Should Be On Your List Of Top Locations For Real Estate Investment?

21st February, 2024

Read More

How is the real estate market shaping up in India?

12th January, 2024

Read More

The Influence Of Technology On Real Estate

5th January, 2024

Read More

How To Accumulate Wealth Through Real Estate?

4th December, 2023

Read More

Dubai Real Estate: A League of Its Own

6th October, 2023

Read More

Chandivali’s Thriving Real Estate Prospect

4th September, 2023

Read More

The Power of a Will and its many advantages

29th August, 2023

Read More

The Bright Prospects of Indian Real Estate 2023-2047

21st August, 2023

Read More

Exploring Ready-to-Move Comforts and Off-Plan Potential in Dubai

16th August, 2023

Read More

MahaRERA's QR Code August 2023 Implementation

10th August, 2023

Read More

India's Booming Real Estate Sector: Growth, Investments, and Infrastructure Expansion

7th August, 2023

Read More

The Significance of Sample Flats for Residential Properties

31st July, 2023

Read More

Hyderabad Real Estate: Unveiling the Rise of Newly Launched Homes and Shifting Buyer Preferences

24th July, 2023

Read More

Luxury Living: Why Now Is the Perfect Time to Invest in Goa

19th July, 2023

Read More

Kalyan Real Estate: A Gateway to a Smart and Thriving Future

14th July, 2023

Read More

The Hidden Costs of Apartment Buying in India: A Buyer's Guide to Informed Purchases

12th July, 2023

Read More

Understanding Real Estate Jargon: Carpet Area, Built-up Area, and Super Built-up Area

7th July, 2023

Read More

Dubai's Office Rents Surge Higher Than London and New York, Indicating Market Recovery

5th July, 2023

Read More

Grade A Commercial Properties: India's Thriving Office Revolution

27th June, 2023

Read More

Maharashtra RERA Implements QR Code System for Transparent Project Information

19th June, 2023

Read More

The Power of First-Floor Tenement

13th June, 2023

Read More

Real Estate Investment Igatpuri

8th June, 2023

Read More

Investment Options and Avenues in Real Estate

19th May, 2023

Read More

Lifestyle living in dubai

15th May, 2023

Read More

Positive Energy Vastu Items for Home Décor

11th May, 2023

Read More

How Technology is Revolutionizing the Indian Real Estate

28th April, 2023

Read More

Drones in Real Estate

25th April, 2023

Read More

The Rise of Pune's Commercial Real Estate Sector - Factors Driving The Growth

18th April, 2023

Read More

What Makes The Tier 2 & Tier 3 Cities Good Places To Invest In

13th April, 2023

Read More

Navi Mumbai Metro Line 1 – The Real Estate Opportunity

7th April, 2023

Read More

The Rising Demand for Housing in IT hub of Navi Mumbai's

6th April, 2023

Read More

Top Reasons that Drive NRI Investment in the Indian Real Estate Market

31st March, 2023

Read More

Gurugram & Noida - The two most promising investment destinations in the NCR

29th March, 2023

Read More

Top Emerging locations of Bengaluru

24th March, 2023

Read More

Women Empowering the Real Estate Market - Discounts and Benefits from Home Loans

21st March, 2023

Read More

Travel from Thane to Dombivli Under 20 Mins - The Benefits of Motagaon-Mankoli Creek Bridge

17th March, 2023

Read More

Top Reasons to Invest in Dubai's Real Estate Market

10th March, 2023

Read More

Pros of Investing In Real Estate in Top Cities In India

9th March, 2023

Read More

Key Drivers of Real Estate Market Growth in Bengaluru

3rd March, 2023

Read More

Beyond Mumbai and Pune - Invest in Maharashtra's Tier II Cities

28th Feb, 2023

Read More

Top 5 Proptech start-ups in India

22nd Feb, 2023

Read More

Why Andheri is Mumbai's Hottest Location To Invest

17th Feb, 2023

Read More

The Ultimate Showdown - Navi Mumbai vs Mumbai

10th Feb, 2023

Read More

REITs VS Fractional Ownership – The Big Picture On How They Work

23rd Nov, 2022

Read More

Housing demand to rise during festive season – Propfynd finds out!

28th Sept, 2022

Read More

Tips to buy property in India

20th Sept, 2022

Read More

Which is better – Buying a house or renting a house in India.

15th Sept, 2022

Read More

Deciding whether to rent or buy a home can be a challenging decision, especially in today's dynamic real estate market. With soaring home prices and increasing rents, many first-time homebuyers are left wondering which path to take. In this blog, we'll explore the key factors to consider when making this important decision. While we strive to present a balanced view, you may find a subtle inclination towards the benefits of homeownership.

1. How long do I plan to stay in the home? When contemplating homeownership, it's essential to assess your long-term plans. While there are costs associated with buying and selling a home, owning a property for at least five years allows you to maximize the financial benefits. Historically, a home's value tends to appreciate over time, riding out market fluctuations. This appreciation can provide a potential return on investment and build equity. Additionally, owning a home offers stability, security, and the freedom to personalize your living space.

Furthermore, as you pay down your mortgage over time, your housing costs will decrease, providing a significant financial advantage. Eventually, you'll reach a point where you no longer have to make mortgage payments, leading to a substantial drop in your housing expenses and the continued growth of your equity and net worth.

2. Is it a better value to buy or rent in my area? To determine the better financial option, it's crucial to consider the specific dynamics of your location. One helpful tool is the price-to-rent ratio, which compares the median home price to the median yearly rent price. However, it's important to remember that this ratio offers only a snapshot of the current market and may not fully account for long-term trends.

Historical data from the National Association of Realtors reveals that homeownership often leads to significant equity gains. For example, a typical U.S. homeowner who purchased a single-family existing home ten years ago would have gained roughly $225,000 in equity while maintaining a steady mortgage payment. In contrast, renters during the same period would have missed out on these equity gains while experiencing a 66% increase in rental prices.

Although renting may seem like a better bargain in the short term, buying a home can be the better long-term financial play, offering potential financial stability and appreciation.

3. Can I afford to be a homeowner? Financial readiness is a critical aspect to evaluate before embarking on homeownership. Start by examining your savings and determine if you'll have enough funds left over after the down payment and closing costs to cover ancillary expenses and emergencies. This safety net is essential to avoid financial strain in the future.

Additionally, consider the impact on your monthly budget. While your mortgage payment is a significant expense, it's important to account for other costs such as property taxes, insurance, association fees, and ongoing maintenance and repairs. Although renting may appear cheaper initially, landlords often pass on the costs of homeownership to tenants, resulting in comparable monthly expenses. Moreover, as a homeowner, you have the opportunity to enhance your property's value through upgrades, renovations, and landscaping, which can contribute to long-term financial growth.

It's crucial to strike a balance between your budgetary comfort and your desired level of homeownership. By aligning your financial goals and capabilities, you can make a well-informed decision about whether buying a home is a viable option for you.

4. Can I qualify for a mortgage? Determining your eligibility for a mortgage is a crucial step in assessing your potential for homeownership. Lenders typically evaluate factors such as job stability, credit history, and savings to ensure that you can handle a monthly mortgage payment.

Having a stable and predictable income is particularly important for lenders. If you're self-employed, you may need to provide additional documentation to prove that your earnings are dependable. Lenders will also assess your debt-to-income ratio to determine if you're at risk of becoming financially overextended.

Your credit score plays a significant role in mortgage approval and the interest rate you can secure. A higher credit score generally improves your odds of obtaining a competitive rate. It's advisable to review your credit report, make timely payments, and manage your debt responsibly to enhance your chances of mortgage approval.

Seeking preapproval from a mortgage professional is a recommended first step before house hunting. By getting pre-approved, you'll have a clear understanding of your budget and can confidently navigate the homebuying process.

5. How would owning a home change my life? Aside from the financial aspects, homeownership brings additional lifestyle considerations. Owning a home requires time, energy, and potentially more maintenance compared to renting. It's important to be prepared for the responsibilities of homeownership, especially if you buy a fixer-upper or commit to DIY projects. For example, maintaining a lawn and managing household repairs may require a significant investment of time and effort.

On the other hand, owning a home provides the freedom to personalize your living space and make improvements according to your preferences. Whether it's creating a beautiful garden, undertaking HGTV-inspired renovations, or enjoying a larger backyard for your furry friends, homeownership can offer a sense of pride and fulfillment.

Furthermore, homeownership often fosters a stronger sense of community. Hosting family gatherings, participating in neighborhood events, and engaging with fellow committed homeowners can contribute to a fulfilling and connected lifestyle.

Conclusion: Deciding between renting and buying a home requires careful consideration of personal circumstances and market dynamics. While this blog provides a balanced perspective, the advantages of homeownership, such as potential long-term financial gains, stability, and personalization, are worth exploring. If you're seeking guidance on the best option for you, our team of local market experts is here to assist.

Contact us today for a free consultation to help you make an informed decision that aligns with your goals and aspirations.

Article authored by: Team Propfynd

Date: 22nd June, 2023

Find Related Blogs Below: -

Maharashtra RERA Implements QR Code System for Transparent Project Information

Women Empowering the Real Estate Market - Discounts and Benefits from Home Loans