The Hidden Costs of Apartment Buying in India: A Buyer's Guide to Informed Purchases

Recent Blogs

Why Location Analysis Matters More Than Price Alone In Real Estate

19th January, 2025

Read More

How to Find Your Ideal Property Using Smart Search Features

2nd January, 2025

Read More

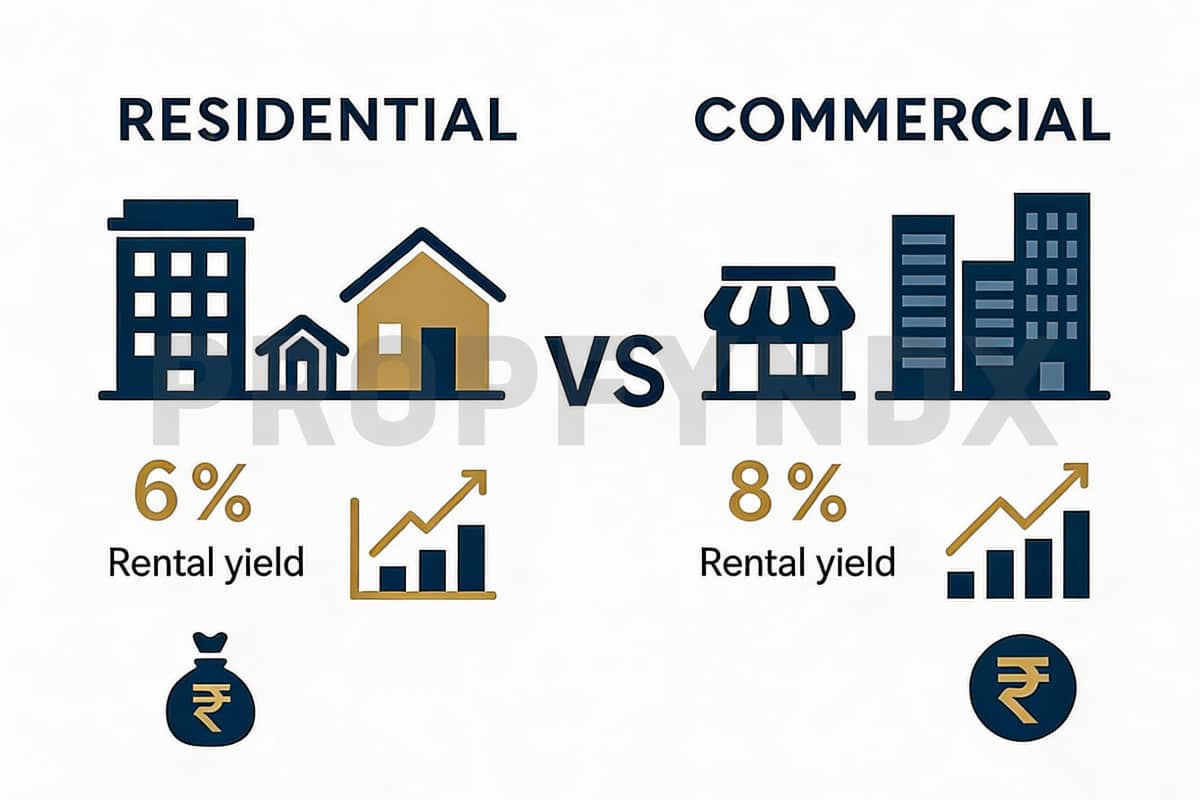

Comparing Investment Returns: Residential vs. Commercial Projects

19th December, 2025

Read More

PropTech in 2026: Why Platforms Like PropFyndX Are Transforming Real Estate

02nd December, 2025

Read More

Ready-to-Move vs Under-Construction Properties: Pros, Cons & ROI

28th November, 2025

Read More

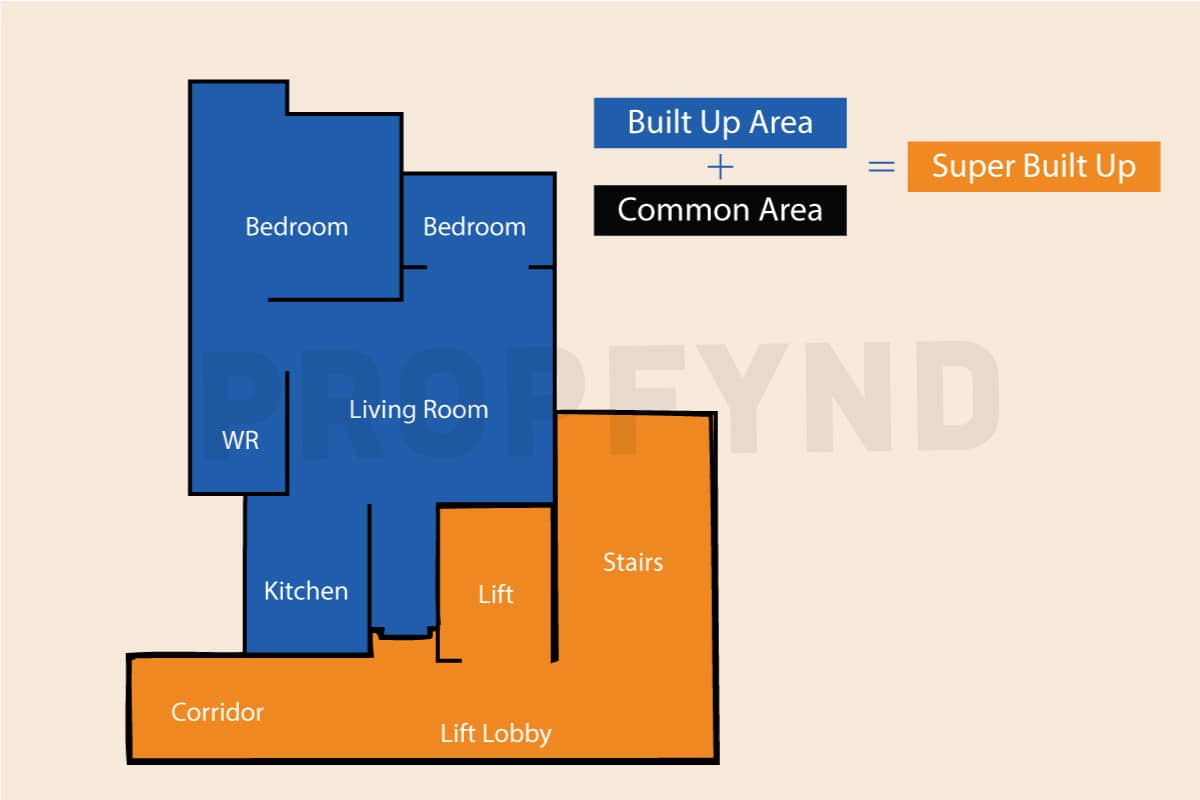

Guide On Carpet Area vs Built-Up vs Super Built-Up Area

27th November, 2025

Read More

Property Discovery Made Simple: How Propfyndx Helps Buyers Save Time

27th October, 2025

Read More

Hidden Costs of Buying a Home: What Property Buyers Overlook

15th October, 2025

Read More

Property Discovery Made Simple: How Propfyndx Helps Buyers Save Time

30th September, 2025

Read More

Residential Vs Commercial: Which Property Type Should You Choose?

15th September, 2025

Read More

RERA Explained: What Every Real Estate Buyer Must Know

22nd August, 2025

Read More

Is It The Right Time To Invest In Commercial Properties In India?

12th August, 2025

Read More

10 Real Estate Ad Mistakes That Are Costing You Conversions

6th August, 2025

Read More

Know How RERA Regulations Are Reshaping Property Marketing in India

30th July, 2025

Read More

How Interest Rate Changes Are Impacting Homebuyers?

30th June, 2025

Read More

Boost Your Real Estate Sales: How Paid Ads Can Help You Sell Properties Faster

20th June, 2025

Read More

Breaking Barriers in PropTech: Challenges & Solutions for Real Estate Innovation

6th June, 2025

Read More

Co-Living & Co-Working: Smart Solutions for Smarter Cities

8th April, 2025

Read More

The Future of Real Estate: How AI is Changing the Game

20th February, 2025

Read More

How Proptech Solutions Are Revolutionising Real Estate in 2025

20th February, 2025

Read More

The Ultimate Guide to Finding the Perfect Warehouse Space for Rent in Mumbai

31th January, 2025

Read More

7 Must-Have Amenities That Define Modern Residential Projects

27th January, 2025

Read More

The Ultimate Guide to Real Estate Digital Marketing in 2025

11th December, 2024

Read More

Top Reasons Why Indians Choose Dubai for Property Investments

28th Nov, 2024

Read More

How does machine learning assist in lead generation for real estate?

20th Sept, 2024

Read More

Luxury Real Estate In Mumbai Registers Record Growth

28th August, 2024

Read More

What’s the significance of virtual tours in the home-buying process?

13th August, 2024

Read More

Why Kalyan Is Emerging As A Preferred Choice For Homebuyers?

19th March, 2024

Read More

The Impact Of The Mumbai Coastal Road Project On Real Estate In Mumbai

11th March, 2024

Read More

How is Andheri’s real estate market shaping up?

5th March, 2024

Read More

Why Thane West Should Be On Your List Of Top Locations For Real Estate Investment?

21st February, 2024

Read More

How is the real estate market shaping up in India?

12th January, 2024

Read More

The Influence Of Technology On Real Estate

5th January, 2024

Read More

How To Accumulate Wealth Through Real Estate?

4th December, 2023

Read More

Dubai Real Estate: A League of Its Own

6th October, 2023

Read More

Chandivali’s Thriving Real Estate Prospect

4th September, 2023

Read More

The Power of a Will and its many advantages

29th August, 2023

Read More

The Bright Prospects of Indian Real Estate 2023-2047

21st August, 2023

Read More

Exploring Ready-to-Move Comforts and Off-Plan Potential in Dubai

16th August, 2023

Read More

MahaRERA's QR Code August 2023 Implementation

10th August, 2023

Read More

India's Booming Real Estate Sector: Growth, Investments, and Infrastructure Expansion

7th August, 2023

Read More

The Significance of Sample Flats for Residential Properties

31st July, 2023

Read More

Hyderabad Real Estate: Unveiling the Rise of Newly Launched Homes and Shifting Buyer Preferences

24th July, 2023

Read More

Luxury Living: Why Now Is the Perfect Time to Invest in Goa

19th July, 2023

Read More

Kalyan Real Estate: A Gateway to a Smart and Thriving Future

14th July, 2023

Read More

Understanding Real Estate Jargon: Carpet Area, Built-up Area, and Super Built-up Area

7th July, 2023

Read More

Dubai's Office Rents Surge Higher Than London and New York, Indicating Market Recovery

5th July, 2023

Read More

Grade A Commercial Properties: India's Thriving Office Revolution

27th June, 2023

Read More

Buy your own home VS Choosing to rent

22nd June, 2023

Read More

Maharashtra RERA Implements QR Code System for Transparent Project Information

19th June, 2023

Read More

The Power of First-Floor Tenement

13th June, 2023

Read More

Real Estate Investment Igatpuri

8th June, 2023

Read More

Investment Options and Avenues in Real Estate

19th May, 2023

Read More

Lifestyle living in dubai

15th May, 2023

Read More

Positive Energy Vastu Items for Home Décor

11th May, 2023

Read More

How Technology is Revolutionizing the Indian Real Estate

28th April, 2023

Read More

Drones in Real Estate

25th April, 2023

Read More

The Rise of Pune's Commercial Real Estate Sector - Factors Driving The Growth

18th April, 2023

Read More

What Makes The Tier 2 & Tier 3 Cities Good Places To Invest In

13th April, 2023

Read More

Navi Mumbai Metro Line 1 – The Real Estate Opportunity

7th April, 2023

Read More

The Rising Demand for Housing in IT hub of Navi Mumbai's

6th April, 2023

Read More

Top Reasons that Drive NRI Investment in the Indian Real Estate Market

31st March, 2023

Read More

Gurugram & Noida - The two most promising investment destinations in the NCR

29th March, 2023

Read More

Top Emerging locations of Bengaluru

24th March, 2023

Read More

Women Empowering the Real Estate Market - Discounts and Benefits from Home Loans

21st March, 2023

Read More

Travel from Thane to Dombivli Under 20 Mins - The Benefits of Motagaon-Mankoli Creek Bridge

17th March, 2023

Read More

Top Reasons to Invest in Dubai's Real Estate Market

10th March, 2023

Read More

Pros of Investing In Real Estate in Top Cities In India

9th March, 2023

Read More

Key Drivers of Real Estate Market Growth in Bengaluru

3rd March, 2023

Read More

Beyond Mumbai and Pune - Invest in Maharashtra's Tier II Cities

28th Feb, 2023

Read More

Top 5 Proptech start-ups in India

22nd Feb, 2023

Read More

Why Andheri is Mumbai's Hottest Location To Invest

17th Feb, 2023

Read More

The Ultimate Showdown - Navi Mumbai vs Mumbai

10th Feb, 2023

Read More

REITs VS Fractional Ownership – The Big Picture On How They Work

23rd Nov, 2022

Read More

Housing demand to rise during festive season – Propfynd finds out!

28th Sept, 2022

Read More

Tips to buy property in India

20th Sept, 2022

Read More

Which is better – Buying a house or renting a house in India.

15th Sept, 2022

Read More

Purchasing an apartment in India can be an exciting venture, filled with the promise of a new home and a sound investment. However, it's crucial to be aware of the potential hidden costs that can significantly impact your budget. In addition to finding the perfect location and apartment, understanding these additional expenses will help you make informed decisions and avoid unexpected surprises.

Let us see what some of these hidden expenses are:

1. Stamp Duty and Registration: Stamp duty is a state tax imposed on property transactions, and its rate varies across states in India. Typically, stamp duty can range from 4% to 8% of the property's value. It's essential to factor in this additional cost while budgeting for your purchase. Additionally, registration fees are payable to the local government for registering the property in your name. These fees can vary from state to state, so conducting thorough research to determine the applicable registration fee will help you avoid any unexpected expenses.

2. Goods and Services Tax (GST): When purchasing under-construction properties, buyers need to account for the Goods and Services Tax (GST). It is a tax levied on the sale of goods and services in India, including under-construction properties. The current GST rate for under-construction properties is 5%. This tax should be factored into your property purchase budget to avoid any last-minute surprises.

3. Legal Fees: Engaging a lawyer to review and draft legal documents related to your property purchase may incur legal fees. The charges for legal services can vary depending on factors such as the lawyer's experience and the complexity of the transaction. Allocating a portion of your budget for legal fees is essential to ensure a smooth and legally sound property purchase.

4. Brokerage Fees: If you decide to involve a real estate agent in the property purchase, brokerage fees will apply. These fees typically range from 1% to 2% of the property value and compensate the agent for their services. It's important to consider this cost when planning your budget and negotiating the terms with your real estate agent.

5. Maintenance Charges: Many apartments come with shared common areas and amenities that require ongoing maintenance. As a buyer, you may be required to contribute to maintenance charges payable to the building society or developer. The exact amount can vary based on factors such as the amenities provided and the size of the apartment. It's crucial to thoroughly understand these charges to accurately plan your long-term financial commitments.

6. Property Tax: Property tax is a local tax imposed by the municipal corporation or local government on property owners. The amount of property tax can vary based on factors such as the location of the property and its assessed value. It's important to factor in these recurring property tax payments when budgeting for your apartment purchase to avoid any unexpected financial burdens.

7. Parking Charges: If you require a parking space for your apartment, additional charges may apply. The cost of parking spaces can vary based on factors such as the location, size, and type of parking facility (covered or open). Considering these charges while assessing your parking needs and planning your budget will ensure you make informed decisions.

Therefore, buying an apartment in India comes with several hidden costs that can significantly impact the overall purchase price. It's essential to be aware of stamp duty, registration fees, GST, legal fees, brokerage fees, maintenance charges, property tax, and parking charges.

Thorough research, consultation with a reliable real estate agent, and careful budgeting will help you make informed decisions, avoid unexpected financial burdens, and ensure a smooth and rewarding apartment purchase experience. By understanding these hidden costs and factoring them into your budget, you can navigate the process with confidence and peace of mind.

Article authored by: Team Propfynd

Date: 12th July, 2023