REITs VS Fractional Ownership – The Big Picture On How They Work

Recent Blogs

Why Location Analysis Matters More Than Price Alone In Real Estate

19th January, 2025

Read More

How to Find Your Ideal Property Using Smart Search Features

2nd January, 2025

Read More

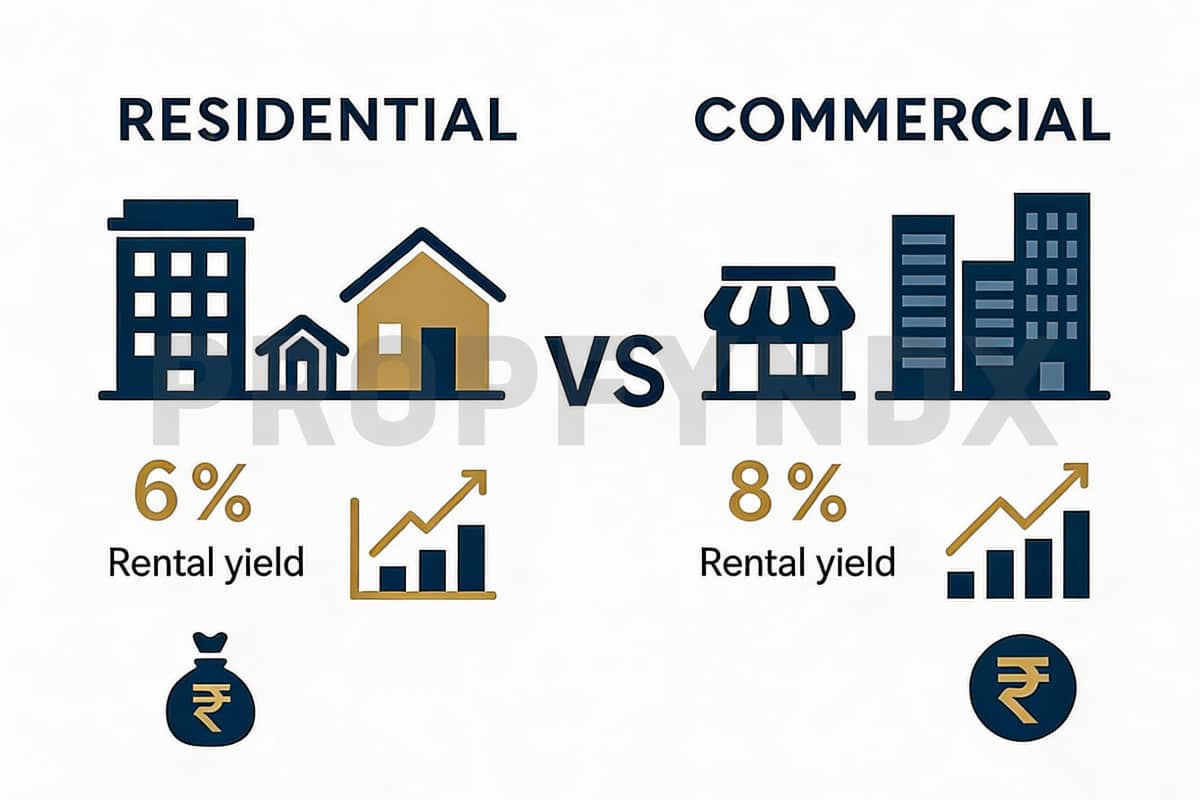

Comparing Investment Returns: Residential vs. Commercial Projects

19th December, 2025

Read More

PropTech in 2026: Why Platforms Like PropFyndX Are Transforming Real Estate

02nd December, 2025

Read More

Ready-to-Move vs Under-Construction Properties: Pros, Cons & ROI

28th November, 2025

Read More

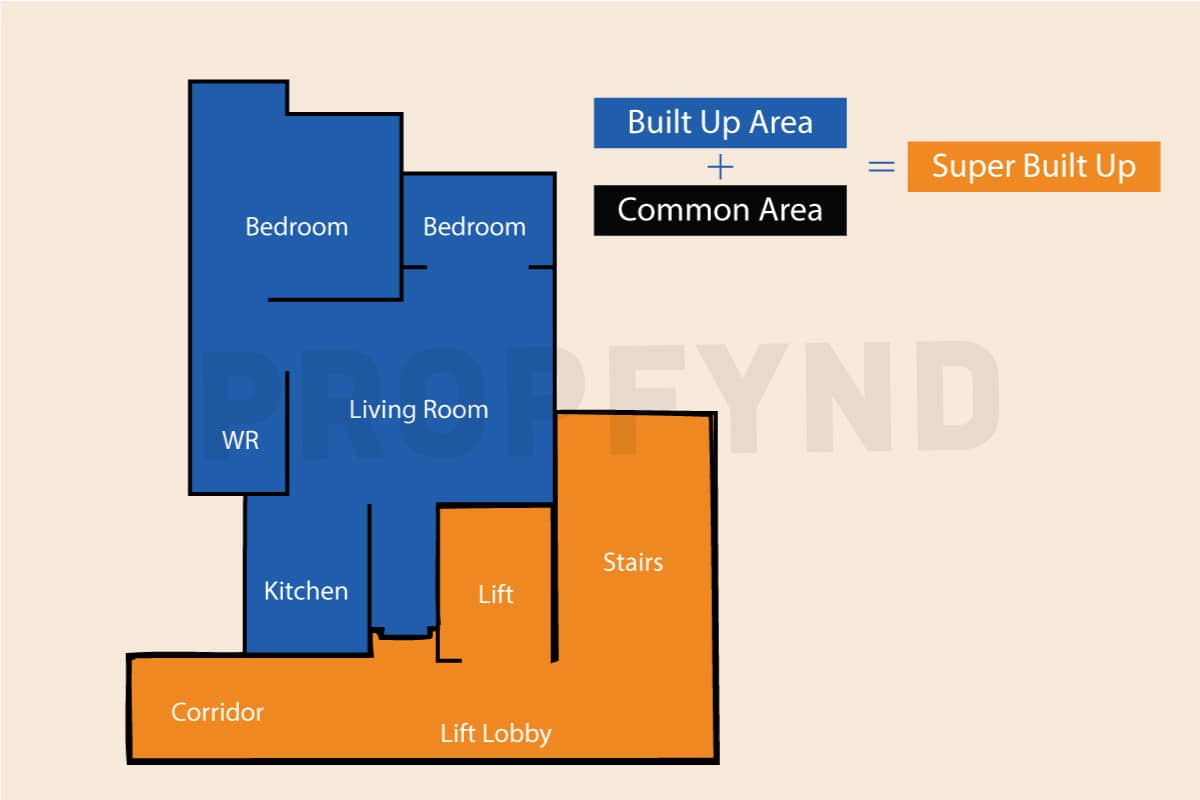

Guide On Carpet Area vs Built-Up vs Super Built-Up Area

27th November, 2025

Read More

Property Discovery Made Simple: How Propfyndx Helps Buyers Save Time

27th October, 2025

Read More

Hidden Costs of Buying a Home: What Property Buyers Overlook

15th October, 2025

Read More

Property Discovery Made Simple: How Propfyndx Helps Buyers Save Time

30th September, 2025

Read More

Residential Vs Commercial: Which Property Type Should You Choose?

15th September, 2025

Read More

RERA Explained: What Every Real Estate Buyer Must Know

22nd August, 2025

Read More

Is It The Right Time To Invest In Commercial Properties In India?

12th August, 2025

Read More

10 Real Estate Ad Mistakes That Are Costing You Conversions

6th August, 2025

Read More

Know How RERA Regulations Are Reshaping Property Marketing in India

30th July, 2025

Read More

How Interest Rate Changes Are Impacting Homebuyers?

30th June, 2025

Read More

Boost Your Real Estate Sales: How Paid Ads Can Help You Sell Properties Faster

20th June, 2025

Read More

Breaking Barriers in PropTech: Challenges & Solutions for Real Estate Innovation

6th June, 2025

Read More

Co-Living & Co-Working: Smart Solutions for Smarter Cities

8th April, 2025

Read More

The Future of Real Estate: How AI is Changing the Game

20th February, 2025

Read More

How Proptech Solutions Are Revolutionising Real Estate in 2025

20th February, 2025

Read More

The Ultimate Guide to Finding the Perfect Warehouse Space for Rent in Mumbai

31th January, 2025

Read More

7 Must-Have Amenities That Define Modern Residential Projects

27th January, 2025

Read More

The Ultimate Guide to Real Estate Digital Marketing in 2025

11th December, 2024

Read More

Top Reasons Why Indians Choose Dubai for Property Investments

28th Nov, 2024

Read More

How does machine learning assist in lead generation for real estate?

20th Sept, 2024

Read More

Luxury Real Estate In Mumbai Registers Record Growth

28th August, 2024

Read More

What’s the significance of virtual tours in the home-buying process?

13th August, 2024

Read More

Why Kalyan Is Emerging As A Preferred Choice For Homebuyers?

19th March, 2024

Read More

The Impact Of The Mumbai Coastal Road Project On Real Estate In Mumbai

11th March, 2024

Read More

How is Andheri’s real estate market shaping up?

5th March, 2024

Read More

Why Thane West Should Be On Your List Of Top Locations For Real Estate Investment?

21st February, 2024

Read More

How is the real estate market shaping up in India?

12th January, 2024

Read More

The Influence Of Technology On Real Estate

5th January, 2024

Read More

How To Accumulate Wealth Through Real Estate?

4th December, 2023

Read More

Dubai Real Estate: A League of Its Own

6th October, 2023

Read More

Chandivali’s Thriving Real Estate Prospect

4th September, 2023

Read More

The Power of a Will and its many advantages

29th August, 2023

Read More

The Bright Prospects of Indian Real Estate 2023-2047

21st August, 2023

Read More

Exploring Ready-to-Move Comforts and Off-Plan Potential in Dubai

16th August, 2023

Read More

MahaRERA's QR Code August 2023 Implementation

10th August, 2023

Read More

India's Booming Real Estate Sector: Growth, Investments, and Infrastructure Expansion

7th August, 2023

Read More

The Significance of Sample Flats for Residential Properties

31st July, 2023

Read More

Hyderabad Real Estate: Unveiling the Rise of Newly Launched Homes and Shifting Buyer Preferences

24th July, 2023

Read More

Luxury Living: Why Now Is the Perfect Time to Invest in Goa

19th July, 2023

Read More

Kalyan Real Estate: A Gateway to a Smart and Thriving Future

14th July, 2023

Read More

The Hidden Costs of Apartment Buying in India: A Buyer's Guide to Informed Purchases

12th July, 2023

Read More

Understanding Real Estate Jargon: Carpet Area, Built-up Area, and Super Built-up Area

7th July, 2023

Read More

Dubai's Office Rents Surge Higher Than London and New York, Indicating Market Recovery

5th July, 2023

Read More

Grade A Commercial Properties: India's Thriving Office Revolution

27th June, 2023

Read More

Buy your own home VS Choosing to rent

22nd June, 2023

Read More

Maharashtra RERA Implements QR Code System for Transparent Project Information

19th June, 2023

Read More

The Power of First-Floor Tenement

13th June, 2023

Read More

Real Estate Investment Igatpuri

8th June, 2023

Read More

Investment Options and Avenues in Real Estate

19th May, 2023

Read More

Lifestyle living in dubai

15th May, 2023

Read More

Positive Energy Vastu Items for Home Décor

11th May, 2023

Read More

How Technology is Revolutionizing the Indian Real Estate

28th April, 2023

Read More

Drones in Real Estate

25th April, 2023

Read More

The Rise of Pune's Commercial Real Estate Sector - Factors Driving The Growth

18th April, 2023

Read More

What Makes The Tier 2 & Tier 3 Cities Good Places To Invest In

13th April, 2023

Read More

Navi Mumbai Metro Line 1 – The Real Estate Opportunity

7th April, 2023

Read More

The Rising Demand for Housing in IT hub of Navi Mumbai's

6th April, 2023

Read More

Top Reasons that Drive NRI Investment in the Indian Real Estate Market

31st March, 2023

Read More

Gurugram & Noida - The two most promising investment destinations in the NCR

29th March, 2023

Read More

Top Emerging locations of Bengaluru

24th March, 2023

Read More

Women Empowering the Real Estate Market - Discounts and Benefits from Home Loans

21st March, 2023

Read More

Travel from Thane to Dombivli Under 20 Mins - The Benefits of Motagaon-Mankoli Creek Bridge

17th March, 2023

Read More

Top Reasons to Invest in Dubai's Real Estate Market

10th March, 2023

Read More

Pros of Investing In Real Estate in Top Cities In India

9th March, 2023

Read More

Key Drivers of Real Estate Market Growth in Bengaluru

3rd March, 2023

Read More

Beyond Mumbai and Pune - Invest in Maharashtra's Tier II Cities

28th Feb, 2023

Read More

Top 5 Proptech start-ups in India

22nd Feb, 2023

Read More

Why Andheri is Mumbai's Hottest Location To Invest

17th Feb, 2023

Read More

The Ultimate Showdown - Navi Mumbai vs Mumbai

10th Feb, 2023

Read More

Housing demand to rise during festive season – Propfynd finds out!

28th Sept, 2022

Read More

Tips to buy property in India

20th Sept, 2022

Read More

Which is better – Buying a house or renting a house in India.

15th Sept, 2022

Read More

Investing in Real Estate entails an obligation that a person can’t afford on his own. Most people opt for loans to invest in commercial and residential properties because they know that it’s one of the best ways to secure their financial future.

Compared to residential properties that buyers may use for themselves or for letting on rent, CRE Properties generally require a lot of investment upfront. Commercial Real Estate Properties have prospects to generate higher income than residential properties.

While investing in CRE properties was once a privilege only available to HNIs/UHNIs, the introduction of concepts like Real Estate Investment Trust (REITs) and Fractional Ownership has enabled investors to buy premium CRE properties in an affordable financial segment.

But out of the two investment options, which one is better for the investment?

Both Fractional Ownership and REITs allows investors to procure premium commercial properties and gain monetary benefits generated by monthly rental income, therefore helping them to secure long-term wealth. However, they operate differently.

REIT is much like mutual funds.

- REITs are no-frills investment vehicles that pool the money of different investors to invest in profitable real estate.

- This makes them a better alternative for those who’d like to invest in real estate without having to own the property or worry about losing money if the market takes a dip.

- Just like mutual funds pool the money and make investments like government bonds, direct equity, stocks, etc., REITs pool money to invest in profitable real estate on your behalf.

- The properties are leased out to business organizations, through which the part-owner gets their share of the capital. But REITs do not allow you the freedom to pick the property to invest in.

- The rental yield from investing in REITs range from 8-10% per year with up to 20% IRR

- The Government of India launched REITs to bring in long-term yield capital into the country and to boost private participation in infrastructure and real estate. India saw its first REIT in 2019.

Three years later there are now three popular REITS - Mindspace REIT, Brookfield REIT and Embassy REIT. REITs as an investment option have gained significant popularity among institutions & retail investors. These three REITS cover 87 million sq. ft. of commercial real estate assets– Mindspace 31 million sq. ft, Embassy 42 million sq. ft. and Brookfield 14 million sq. ft.

What is Fractional Real Estate Investing?

- • Fractional real estate investing allows you to purchase fractions of an investment property.

- • By purchasing fractions, you get to invest in real estate at a fractional rate in order to have a higher income potential than buying the whole property outright.

- • The amount of your fraction is based on ticket size and minimum share that you want to hold.

- • One example includes if there are a total of 10 tickets available and you decide to purchase 2 of them, you now own 20% of the property and get your share of the money generated through it (or keep purchasing more)

- • Fractional ownership market is expected to grow by 13% to 18% in the coming five years

“It is estimated that over the next three years, the fractional ownership market's worth will reach five billion dollars. This is a shot in the arm for the real estate industry,” Shiv Parekh, the founder of Hbits.

According to data compiled by hBits (fractional ownership realty firm) fractional ownership has seen a surge over the last five years with an estimated total transaction of Rs 750 crores. Out of this, Rs 350 crores worth of transactions took place in 2020, i.e., after the first Covid lockdown was imposed.

REITs Vs Fractional Ownership

| Sr. No | Real Estate Investment Trusts | Fractional Real Estate Investing |

|---|---|---|

| 1. | REITS are directly monitored by SEBI | Fractional ownership does not come under the purview of SEBI |

| 2. | 80% of the funds should be invested in developed and income generation properties | There are no barriers here. Investment allowed in developed as well as under-construction properties |

| 3. | Investors have no control to choose the type of properties | Investors have full control and flexibility to choose the type of properties |

| 4. | No upfront costs and maintenance charges are charged | They are charged brokerages and maintenance costs |

| 5. | Minimum Investment amount is as low as 10-15k | Minimum investment amount is high around 25lacs |

| 6. | REITS are very liquid and the returns are comparatively consistent | Higher income potential but the returns usually keeps fluctuating |

The bottom line, of course, is to do due diligence on the asset class before investing. Fractional property and REITs both work differently and give investors different benefits. Ultimately, it all depends on your goals for your investment.

Article authored by: Team Propfynd

Date: 23rd Nov, 2022